that nubank It is one of the largest digital financial institutions in Latin America and is not news to anyone. Fintech is full of products, the most in demand being the non-annual credit card, which also has a feature that allows you to build a limit.

In short, this function reserves part or all of the cardholder’s digital account balance to be used as a credit line. This way if the user needs 500 Brazilian Real To make a purchase, simply deposit that amount and keep it as a credit on the card.

Then, when the transaction is executed, the amount is not available for use, until the credit card bill is paid. After payment, the customer will get the balance back, and be able to choose between leaving it as a maximum, leaving it in the account or withdrawing.

to me nubankYou can use up to 5 thousand Brazilian riyals In the function of building a limit on a credit card. In addition, the user can make both domestic and international purchases, both in person and online.

However, it is important to note that if the user fails to pay the bill by the due date, the bank can deduct the amount to guarantee payment. In addition, there are additional fees, such as fines, interest, and IOF.

How do you use the function?

- Access to the application nubank;

- Enter the list of credit cards;

- Click on the “Set Limit” option;

- Once done, tap on Maximum Booking and enter the desired amount.

Resource Advantages

Although the feature does not seem useful to many people, considering that it is the user who provides his own limits, the functionality can be very useful for those who do not have a pre-approved credit.

“This card works like this for a simple reason: Instead of denying access to a credit card, we let you create a credit history with us: by booking a limit and paying your bill for a period of time, our system can create a new credit history.” information, gives you a pre-approved limit,” fintech explains.

See what success is on the Internet:

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

:strip_icc()/s02.video.glbimg.com/x720/12553381.jpg)

:strip_icc()/i.s3.glbimg.com/v1/AUTH_fde5cd494fb04473a83fa5fd57ad4542/internal_photos/bs/2024/g/0/V5FYuBQliYVGYOkMB4Aw/thumbnail-amanda.jpg)

More Stories

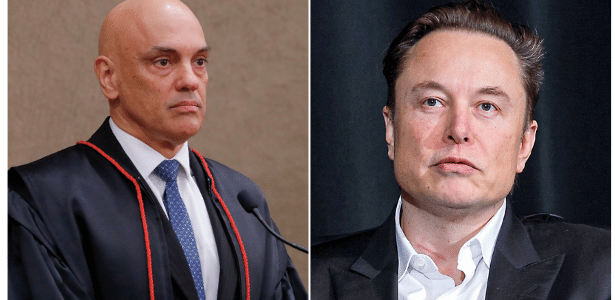

So far, Musk has only been emboldened by threats to ignore justice

Miley's government says it is seeking a “Lula model” for bank privatization

Zuckerberg loses 100 billion Brazilian reals from day to day, and Musk surpasses him in the global rankings of the richest people. See the numbers