Lindbergh Farias and Alencar Santana compete in the Campos Neto initiative on interest-free installments on card purchases

✅ Get news from Brasil 247 and TV 247 on Brazil channel 247 and on Society 247 On WhatsApp.

247 – Workers’ Party representatives Lindbergh Farias (RJ) and Alencar Santana (SP) submitted a request to the President of the Chamber, Arthur Lira (PP-AL), asking to disavow the President of the Central Bank, Roberto Campos Neto. The dispute arises due to consideration, without legal basis, of reducing the number of interest-free installments on credit card purchases.

According to a report from Newspaper Folha de São Paulo In the document submitted, the deputies say that several party leaders in the chamber have already discussed the topic and opposed the initiative being analyzed by the Central Bank. They claim that any restrictions in this regard could harm consumers, further benefiting large banking institutions.

Alencar Santana, project rapporteur who created Desenrola Brasil, a debt renegotiation program to reduce defaults in the country, highlights that at the time of treatment, about 71 million people (equivalent to about 43.78% of Brazil’s population) had Credit restrictions due to debt. The program allowed these people to negotiate their outstanding balances through discounts and lower interest rates, removing them from the default registers.

The representatives point out that Congress sought to find mechanisms to prevent these people from returning to negative status, mainly through the revolving credit card, whose interest reached 439.24% annually during that period. The recently approved law sets limits on interest rates and financial fees, but, according to parliamentarians, it does not impose restrictions on interest-free installment purchases on credit cards.

Continue following recommendations

They stated in the application that based on studies and discussions conducted at central bank meetings, interest-free installment purchases on credit cards have proven to be a beneficial measure for consumers. This method allows purchases to be financed without arbitrary interest rates being imposed by banks, which directly benefits the population.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

:strip_icc()/s02.video.glbimg.com/x720/12553381.jpg)

More Stories

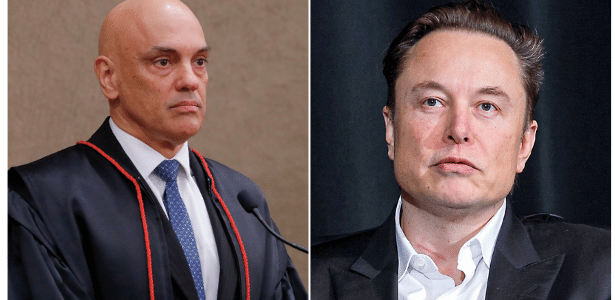

So far, Musk has only been emboldened by threats to ignore justice

Miley's government says it is seeking a “Lula model” for bank privatization

Zuckerberg loses 100 billion Brazilian reals from day to day, and Musk surpasses him in the global rankings of the richest people. See the numbers