Despite Nubank’s short period of activity, it has become one of the largest institutions providing financial services in Brazil as well as in Latin America. In addition to the total customers from Colombia and Mexico, two of Nubank’s other markets, Brazil alone accounts for a customer base of more than 64 million.

Much of this rapid growth can be related to the fact that fintechs are constantly delivering news to their customers. Now, Nubank has launched a new resource that can help those who need a credit boost but can’t.

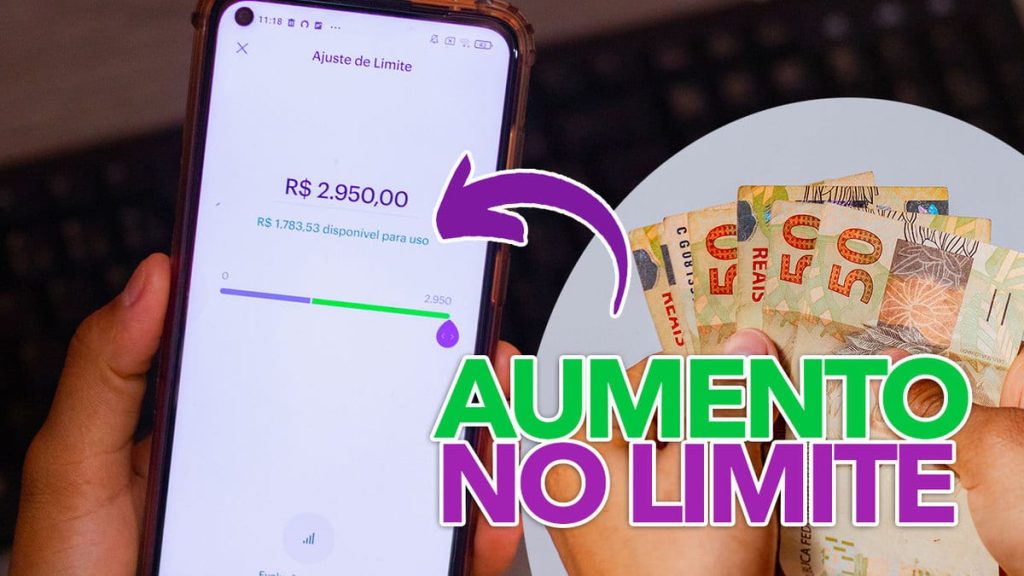

Nubank allows credit increase

First of all, it is important to stress that Nubank’s new feature that allows you to increase your credit card limit is now available to all fintech customers.

It should be noted that the Nubank card is one of the most popular Nubank cards today. Much of this stems from the fact that the foundation issues no annual wages, in addition to other benefits.

However, when applying for a card for the first time, the credit limit that is issued may not be enough for many people. With the new function, it is possible to increase the limit up to R$5,000.

See also: Can all Nubank users get a deposit of R$300.00? Learn how to win!

How it works?

The feature works as follows: the customer can reserve the balance of his account, in whole or in part, to use as a line of credit.

For example, suppose a customer’s line of credit is R$600, but that same customer needs to buy R$900.

In this sense, the customer can choose to deposit R$400 into the Nubank account as a credit, and then return that amount to a line of credit. With it, a person can pass the purchase.

It is important to note that once a person chooses to hold these funds as a cap, they will not be available for use automatically.

This way, the amount will only be released again when the customer pays the card bill. Once this is done, the balance in the account is released again and it will be possible to choose to use it again as a maximum, or to select another way to use it.

How do you use the feature?

- Open the Nubank app and log in;

- Select the “Credit Card” option, and after that, keep touching “Set Limit”;

- Next, tap on “Book as Limit”;

- Verify all information and if you agree, continue;

- Enter the amount of balance you want to use as the card limit;

- You will need to read the terms and conditions of the operation again and, if you agree, confirm the transfer;

- Enter your 4-digit account password;

- Then the new limit will be available in a matter of moments.

Finally, it should be noted that this method may be useful mainly for customers who do not have pre-approved credit.

By creating a payment history with Nubank, the system will be able, over time, to perform a new analysis to check if the credit can be released.

See also: Accounts under these Terms may be canceled by Nubank; Know what to do

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

/https://i.s3.glbimg.com/v1/AUTH_bc8228b6673f488aa253bbcb03c80ec5/internal_photos/bs/2024/V/A/331F8qSPGcp8g41HUPAw/gettyimages-2150216534.jpg)

More Stories

Cielo (CIEL3) profits of R$503.1 million in the first quarter, a year-on-year increase of 14.1%.

Nubank announces subscription plan with cashback and MAX access

Klabin (KLBN11) announces dividend. Check details: