Today, the shareholders of the Zamp company, which owns Burger King in Brazil, refused to include a poisonous pill in the company’s articles of association, leaving the way open for Mubadala to increase its stake and achieve control over the company.

- Mubadala buys another 13% of Zamp before deciding on the toxic pills

- Who will get a bite of Burger King?

Rejection of the mechanism proposed by Mar Asset, which calls for the inclusion of a clause obligating the investor who acquires a share of more than 25% of the company to submit an acquisition offer (OPA) on the rest, by a majority of 57.2% of the vote. To the shareholders present at the Extraordinary General Assembly meeting. This group represents 77.2% of the company’s capital.

- After the stock drops nearly 50%, the owner of Burger King orders poison pills

And in August last year, Zamp’s board of directors rejected an offer to acquire 45% of the company from Mubadala, citing low prices. The holding company that owns the Burger King and Popeyes networks in the US also appeared at the time, alleging that the deal with Mubadala would have violated the restrictive clauses of the Brazilian trademark contract because of the fund’s involvement in other projects. franchise networks.

- In the new capitalization of Creditas, the founder also contributes

Less than a year later, the Arab Fund applied to the company again. And he bought the shares this month through an auction, and his percentage reached 21.03%, becoming the largest shareholder in Zamp Company. Other shareholders are FitPart, a family office subsidiary of former Banco Garantia partners, who own 15.29%, Restaurant Brands International (RBI), global owner of the Burger King and Popeyes brands, with 9.4%, and Mar Asset with 6.32%. .

Since rejecting the hostile bid, on August 17 last year, Zamp shares have lost 33% and closed at R$5.55 on Thursday.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

:strip_icc()/s02.video.glbimg.com/x720/12553381.jpg)

:strip_icc()/i.s3.glbimg.com/v1/AUTH_fde5cd494fb04473a83fa5fd57ad4542/internal_photos/bs/2024/g/0/V5FYuBQliYVGYOkMB4Aw/thumbnail-amanda.jpg)

:strip_icc()/i.s3.glbimg.com/v1/AUTH_b3309463db95468aa275bd532137e960/internal_photos/bs/2022/j/u/Ji43CcTGWhpZXaMVyLLA/bk.jpg)

More Stories

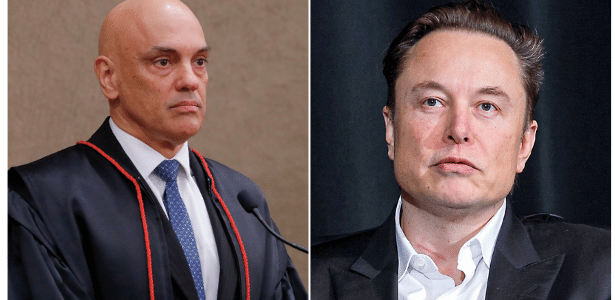

So far, Musk has only been emboldened by threats to ignore justice

Miley's government says it is seeking a “Lula model” for bank privatization

Zuckerberg loses 100 billion Brazilian reals from day to day, and Musk surpasses him in the global rankings of the richest people. See the numbers