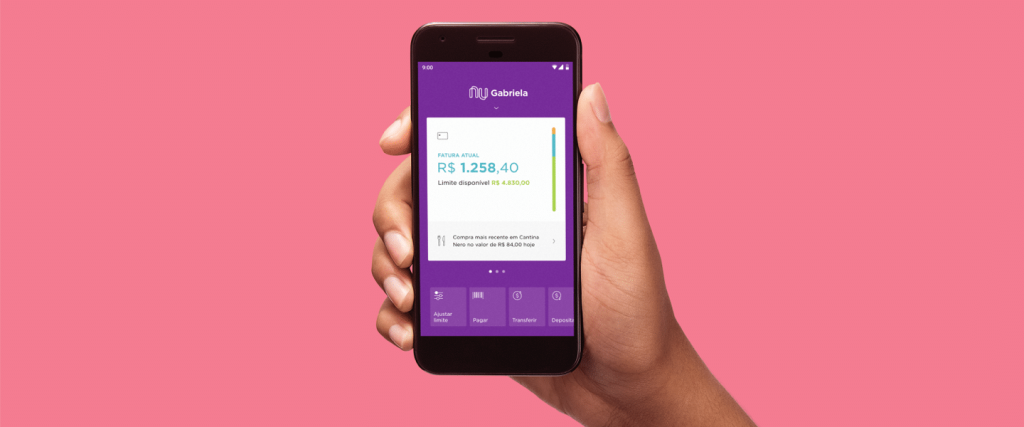

a nubank It is a digital bank created to simplify the financial life of individuals. The novelty launched by the company allows customers Pay specific purchases with your credit card directly in the application. The idea is to ensure that users enjoy discounts on cash payments or transactions from places that do not offer premiums.

Read more: New Nubank Promo R$75 PIX? The truth or the lie?

In general, installment purchases in Credit card The invoice is used as a whole. However, Nubank provides customers with a choice Installment for a specific purchase (generally higher value), without the need to activate higher interest rates or service revolving credit.

With the new function, the consumer can split the purchase up to 12 times. But for this, the amount must be paid in cash and in transactions that cannot be paid in installments at the time of purchase.

How to pay in installments for a specific purchase through the Nubank app?

Here is the step-by-step guide to paying for a single purchase in the Digital Banking App:

- arrive to nubank app;

- Next, go to the Credit Card section and press “Parcelar Compras”;

- Next, select the purchase that you want to pay in installments and specify the number of instalments;

- Go ahead and click View Summary. From there, check the payment terms and conditions and press Continue;

- Sure!

After completing the steps, the purchase amount on the invoice is automatically updated. It is important to note that the installment may not be modified or canceled after it has been approved. However, the customer can expect to pay the installments and get a discount at any time.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!