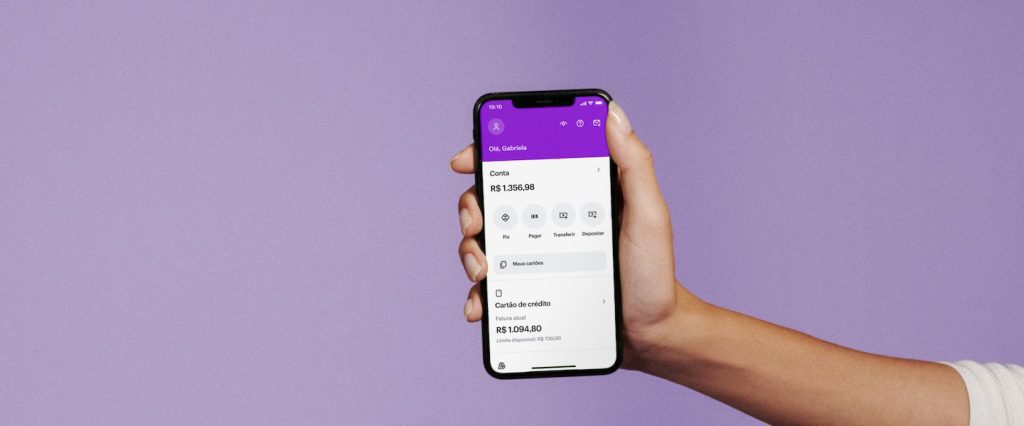

a nubank announced on Tuesday, 25th, the launch ofextra limit‘, to be used to pay vouchers with Credit card. Novelty allows clients financial technology Additional value for making transactions of this type without having to compromise the purple limit until then.

Read more: Nubank promotion will launch 3,000 BRL for customers to purchase McDonald’s

The financial technology He explains that the new feature will be rolled out gradually to customers in the coming weeks, and for that, the app needs to be updated. This way, at least in the beginning, only a small group will be able to reach the additional limit.

According to Digital Bank, there are many advantages to using a credit card in Pay tickets. They include: centralization of all expenses in a single bill, practicality in paying bills in installments on the card and the possibility of foreseeing installments.

Learn how to use your Nubank Card Additional Limit

In short, the additional limit varies from person to person, as Nubank will take into account the same criteria analyzed for awarding the normal credit card limit.

To check the value of the enabled additional limit, the customer only needs to check it when making this type of payment. See step by step below:

- access to the Nubank app;

- Then, on the main screen of the application, click “Pay”;

- Select the option “Pay Vouchers” and then scan the voucher or enter the barcode manually;

- Click on “Choose a Payment Method”. If you have an additional limit available, you will see this information from this screen;

- Select the “Credit Card” option and then choose how often you want to pay in installments;

- Check all the information, go to “Payment” and enter your password.

Taking into account that the additional limit issued by the bank may change over time, depending on the volume of purchases made with the payment voucher on the card and the financial history of the customer.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Carrefour (CRFB3) achieved a 2.5% increase in sales in the first quarter, reaching R$ 27.8 billion.

Copel Assembly (CPLE6) approves dividend payment. See details:

UBS says the momentum of the Big Six tech companies is “collapsing.”