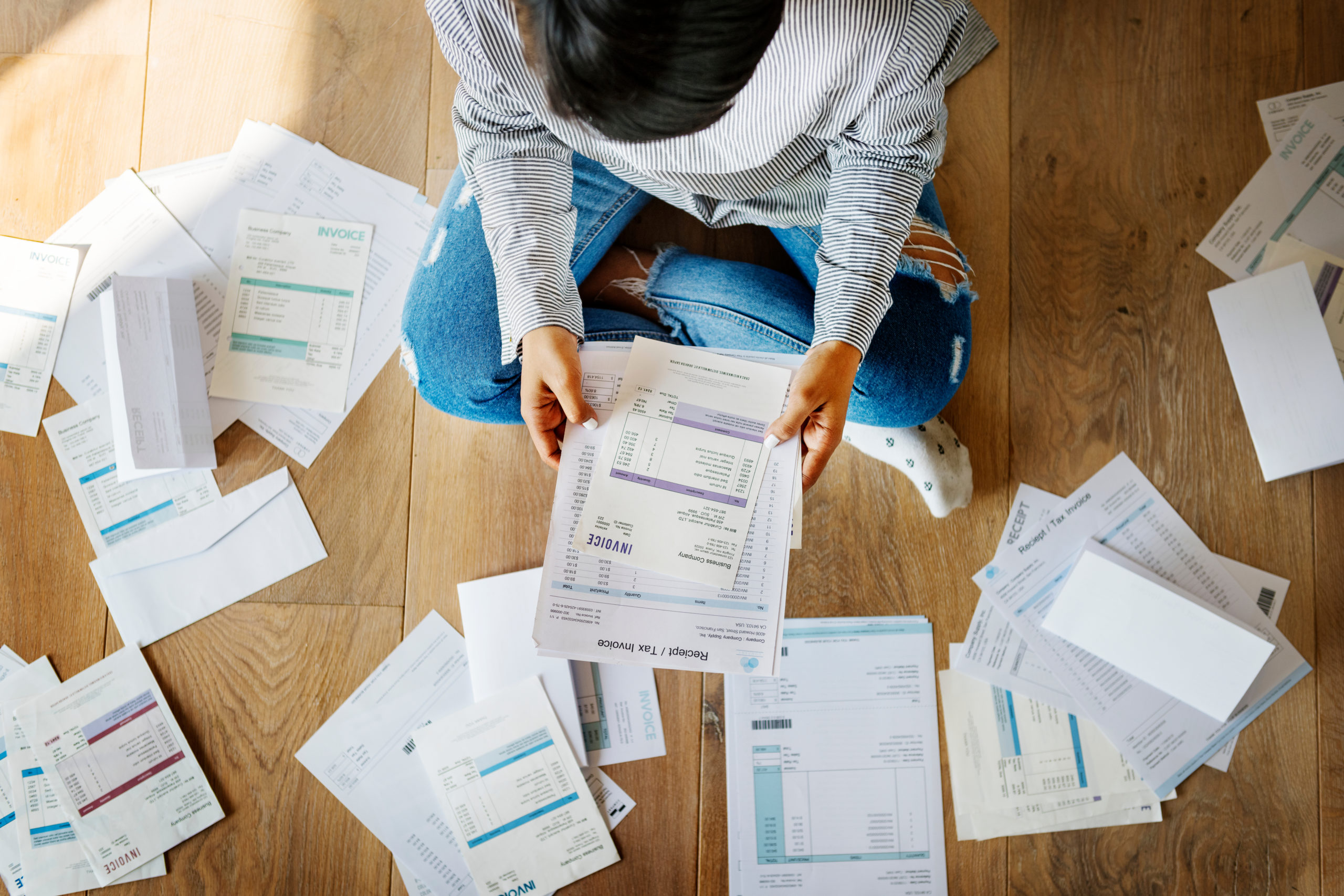

Debt is a “common” situation in the financial life of individuals and companies, which can be caused by various factors such as unemployment, low income, excessive spending, and others. According to the Credit Protection Service (SPC Brasil), in September last year, 64 million people were in debt.

Read more: Default and Debt: Yes, there are differences; Understand the impacts on your pocketbook

A significant part of this negative group has doubts about what happens to a suspended period of more than five years of existence, that is, it has “expired”. Find out the answer throughout the text.

There is a widespread belief that after five years have passed since the name has been included in the defaulters’ registers, the debts “fall out” and thus no longer have to be repaid to the creditors. And why do many people think this?

When the debt is not settled, the creditor can take some actions to collect it, such as including the name of the debtor in the records of credit entries, but there is a deadline for the creditor to sue the debtor in court to collect this debt, which is known as Limitation period.

In this context, there is a belief that all debts expire after five years, but this is incorrect.

Debtors are not free of debt after five years

Contrary to what many people imagine, debt does not go away after five years. According to attorney Danilo Montemurro, in an interview with R7, what expires is the collection deadline, not the debt.

According to the lawyer’s explanations, the civil law It introduces a series of deadlines for people to file a lawsuit in court to claim certain rights. These terms can vary from one year to ten years. For cases involving groups of financial institutions, the term can be five years or more.

During this period, the creditor may file a lawsuit to collect the debt. For this reason, it will not expire. Thus, the limitation period is interrupted, so the debt is collected even after that period.

Many people raise this confusion because there is an article in Consumer Protection Acts.

In the box “What do I do, Sofia”, journalist and lawyer Sofia Camargo explains that the maximum time a debtor’s name can remain on the defaulter’s list is five years. After this period, the creditor is obligated to remove the name from the list, even if the debt is not settled. This is what the Defense Code says.

Now, in the event that the creditor did not charge anything during the limitation period, we can say that the collection period has expired and he will not be able to go to court to claim his rights.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

How Eletrobras intends to further reduce payroll expenses

Caught! BYD Shark pickup truck seen without any camouflage before its debut

The SP government is holding an energy auction on the 19th, at B3- Capitalist